Mobile / smartphone payment

- TOP

- Mobile / smartphone payment

A versatile service that does not require a payment terminal!

This is a credit card payment service that allows you to use your cell phone as a credit card payment terminal.

Credit card payments can be made anywhere in Japan, as long as there is an Internet connection.

Since a dedicated credit card payment terminal is not required, costs can be reduced.

In addition to general cell phones, the service is also compatible with smart phones.

This is a versatile payment service that can be used in all kinds of situations, such as in stores, storefronts, and customer locations.

There is no need to carry a payment terminal or computer with you when you go out.

There is no need for any special setup, just follow the on-screen instructions and enter your payment information.

In addition to paper receipts, the system also has a function to notify customers of payment details by e-mail.

A “payment completion e-mail” is also sent immediately to the company’s registered e-mail address.

Payment can be made at a card reader terminal in the store, or on a cell phone when on the road.

Since the payment is made on the merchant’s dedicated payment page, security is assured.

Mobile phone / smartphone payment flow

Settlement is completed in just 3 steps! Easy and convenient portable credit card payment service.

You can make payments “anytime” and “anywhere” as long as there is a signal!

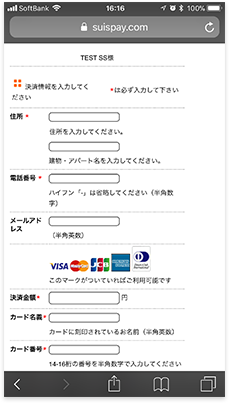

Step1 Enter information

Log in to the dedicated payment screen from the payment URL sent by us. Please enter your card information, payment amount, etc. according to the instructions on the screen.

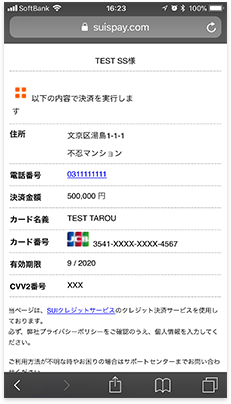

Step2 Confirmation of input information

After inputting, a confirmation screen will be displayed.

If there are no changes, click on Execute Payment with this information.

Step3 payment completed

If the payment is successful, your

ID will be displayed.

Optimal payment screen

We have prepared the most suitable payment screen for mobile payment as a payment method used by member stores.

We believe that the good payment service that SU HONG KONG payment service considers is a simple credit card payment structure that can be performed quickly, safely, and easily.

We also provide the most suitable payment screen for mobile payment as a means of payment for merchants.

We at SU Hong Kong Payment Service believe that a good payment service is a simple credit card payment structure that is fast, secure, and easy to use.

We often see payment services and payment services that pursue high security and high functionality to the detriment of user activity. Our card payment services place the highest priority on improving sales opportunities for merchants and increasing sales.

Easy payment anywhere with cell phones and smartphones.

Just enter the required information to complete the payment.

Of course, even with mobile payment, we are fully equipped with security measures such as CVV input.

Benefits of mobile / smartphone payments

merit1 No phone line required!

Since you can use your mobile phone as a credit card payment terminal, even those who do not have a telephone line can install it immediately.

merit2 Payment is possible even on business trips!

Payment can be made anywhere in Japan where mobile phones are connected. Of course, payment on the move is also possible. Details to customers can also be issued on the spot.

merit3 No terminal cost required!

Simply enter the dedicated URL on your mobile phone and your mobile phone will instantly switch to a credit card payment terminal.

merit4 Immediately increase the trust of the store by introducing it earlier than anywhere else!

We have built SU HONG KONG’s unique screening system, and with the tremendous trust of financial companies, we were able to achieve the fastest introduction speed. SU HONG KONG can be installed in as little as 3 days. I can’t wait for more than a month! SU HONG KONG can answer your request! The five major credit card brands give customers a sense of security.

Mobile phone / smartphone payment case studies

-

Door-to-door sales customers

Most of the sales are by visiting, but I am grateful that there is no need to prepare a new terminal, and above all, there is no need to carry heavy machines, PCs, printers, etc. In the past, I used to carry a dedicated payment terminal and printer with me, so all the employees are happy that it has become much easier. It is very convenient because you can make a payment immediately with just one mobile phone that you always carry with you.

-

Customers in the car repair and road service industry

When I got an estimate from another company before, I heard that the introduction cost tens of thousands of yen and the running cost was 10,000 yen or more, so I once gave up on but after getting an estimate, SU HONG KONG’s Affordable I was surprised. The fact that there is no terminal cost was a great help to us, who cannot afford to spend much. When customers come to the store, we use card reader terminal payments, and on-the-go payments are used in combination with mobile phone payments.

-

Restaurant

When opening a restaurant, I was looking for a payment agency in a hurry. I didn’t have the space to put a computer, a device that takes up space, or a printer, so I chose mobile phone / smartphone payment. It took only a week to open, but it took only 3 days from application to introduction. Thanks to you, we were in time for the opening. It was a sudden introduction consultation, but thank you for your kindness.

-

Customers in the driving agency business

I run a driving agency as an individual. I was looking for a payment agency that even a sole proprietor could join. Although it was refused by other companies, SU HONG KONG was able to join us. In the past, we used to do the agency business only with cash, but there were many occasions when we inconvenienced our customers because they didn’t have any. Customers are pleased that it has become “convenient” since we accepted credit card payments. The use of repeaters has also increased.

-

Customers in various event industries

There are many opportunities to hold solo exhibitions and booth exhibitions, and depending on the venue, it is prohibited to bring in a computer, so I was looking for a credit service that could handle such venues. I often handle high-priced products, so I feel that card payment is essential. By supporting card payments, sales have also increased significantly.

-

Aesthetic salon

We receive services on a floor different from the office. Previously, I used to bring my credit card to the office floor on the second floor, but there was also a request to make a payment in front of me. With mobile phone payments, you can make credit payments anywhere, so you can make payments in front of each customer. After receiving the service, we are very pleased by our customers because we can make payments on the spot while sitting in a chair.

-

Home cleaning customers

We provide a cleaning service by visiting your home. I’m often asked about additional services, but sometimes he said, “I don’t have one, so next time …” and he decided to introduce card payment because he was losing sales opportunities as it was. .. After introducing credit card payment, it became easier to recommend “There are additional services like this.” The monthly cost is low and I am satisfied.

-

Customers selling beauty equipment

We sell beauty equipment for salons. Since I often visit, I introduced mobile phone payment. It is very convenient because you can make payments at any time using each employee’s mobile phone or smartphone. Each sales can be managed and confirmed collectively on the management screen, which is also useful for work in the office. It is good that we can confirm the payment and request cancellation at any time.

Ideal for credit card payments in the following industries and events!

- House cleaning

- Driving agency business

- Research business

- Events / Events

- Non-store type industry

- Social contribution activities of non-profit organizations (settlement of donations and admission fees)

In addition, it can be used by a wide variety of industries.